Retirement Planning

Retirement Planning

Retirement is one of the most important life event that many of us will definitely going to experience. This is that stage in which we only have cash outflows. Despite of only cash outflows there are many myths, I don’t need retirement planning, I am not too old, I will wait for a lump sum, I am having family or external support, I will not live that long or I won’t retire.

Retirement planning involves organising your assets and savings, into plan that will meet your goals for retirement. Taking into account your needs, time-frame and goals. We identify and help you to make informed decisions on a number of personalised strategies that will maximise your wealth for your retirement.

We can also help you with regards to Self-Managed Funds (SMF), which can give you greater flexibility, investment choice and control over your superannuation.

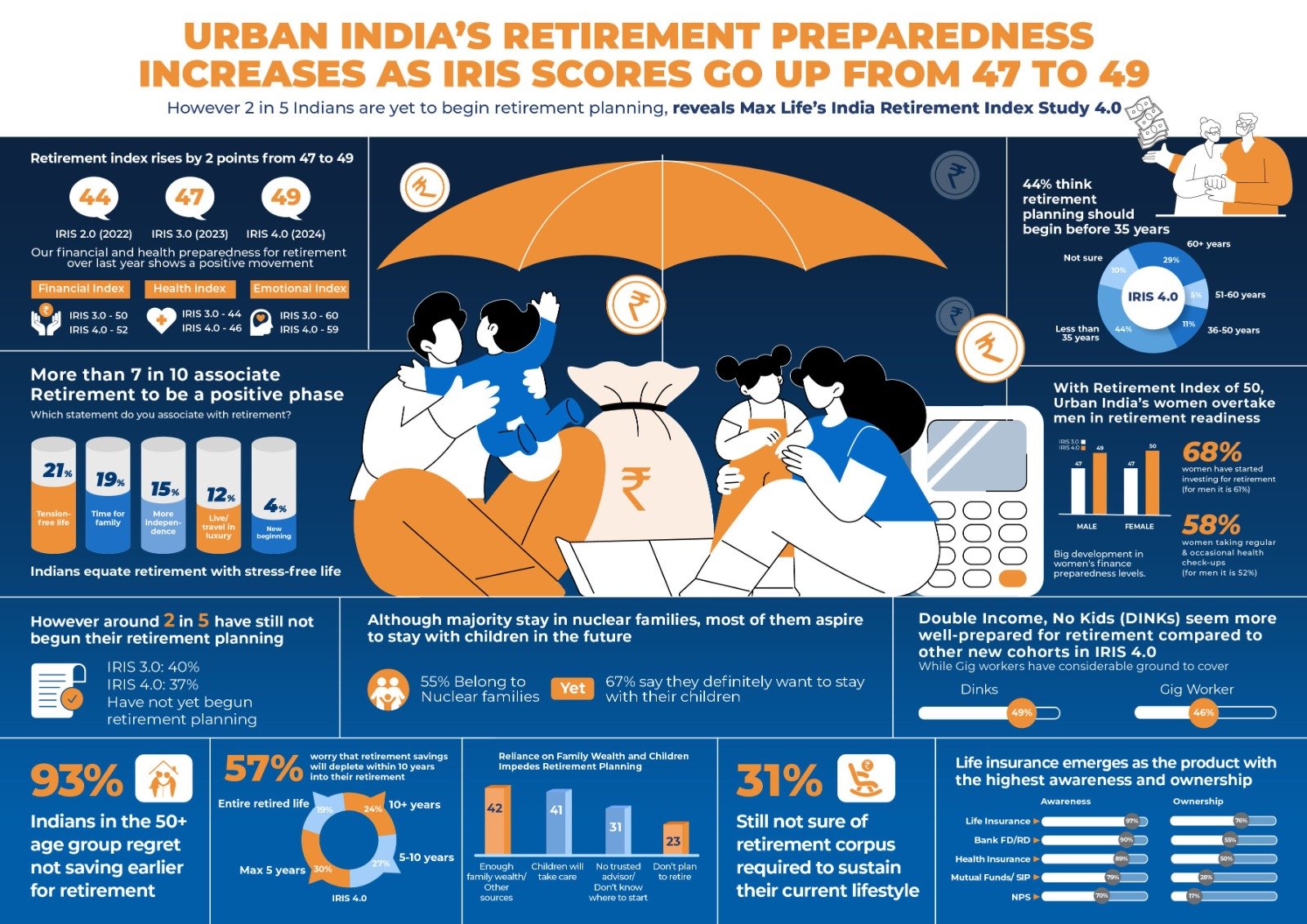

93% Indians in the age group 50+ regret not saving earlier for retirement. 57% worry that retirement saving will get deplete within 10 years into their retirement. 31% says they didn’t get a trusted advisor / don’t know where to start. 31% still not sure of retirement corpus required to sustain their lifestyle.

Source: - Axis Max Life Insurance survey-2024

Why you should go for Retirement Planning?

Basically retirement planning is essential to maintain your life’s living standard. It is a future assurance that you no longer need to worry and dependent about your expenses like medical, daily expenses, when you permanently retire from your job.

We prepare retirement planning as per your retirement goals, current financial condition, and expected income after retirement while consideration your current expense, results you get, what you exactly need on your retirement age or retirement from job. We provide advisory regarding easy retirement and when to retire.

Retirement planning gives suggestions on easy adjustment to expenses and financial needs post retirement, avoiding any dramatic change in your life style post retirement from job, availing significant tax benefits that you can get on your retirement pension plan account and providing financial protection to the people dependent on you for any kind of financial support.

Calculate Your retirement corpus Via Current Monthly Expense

Calculate NowWhat is meant by Retirement Planning

Retirement planning is the process of preparing for and managing your financial resources to ensure that you can live comfortably during your retirement years. It involves assessing your current financial situation, determining your retirement goals and objectives, and developing a strategy to help achieve those goals. It also involves making decisions about how to invest your money, how much to save, and how to manage your debt.

Here are a few examples of what retirement planning can include:

Assessing your current financial situation:

This includes understanding your current income, expenses, debt, and assets, and determining how much money you will need to retire comfortably.Setting retirement goals:

This includes determining how much money you will need to live on during retirement, what kind of lifestyle you want to have, and how long you expect to live in retirement.Developing a savings and investment strategy:

This includes determining how much you need to save each month in order to reach your retirement goals, and deciding how to invest your money to help it grow.Maximizing government benefits:

This includes understanding how government benefits such as Social Security and pension plans can help supplement your retirement income.Managing debt:

This includes paying off any high-interest debt, such as credit card debt, before retirement, in order to reduce the amount of money you need to live on during.It’s important to note that retirement planning is a continuous process and requires regular monitoring, updating, and adjustments. It’s recommended to consult a financial advisor or professional retirement planner to help design, implement and manage a retirement that aligns with your investment goals and risk tolerance.